Why You Can’t Resist Impulse Buying — 5 Proven Ways to Stop Now

June 1, 2025 | by Mindseek

You didn’t plan to buy it. Maybe you were just scrolling — looking for a distraction, not a deal. But somewhere between “20% off” and “Only 3 left,” it happened. Another package on the way. Another unplanned purchase.

And afterward? That familiar mix of thrill and regret. You promise to be more mindful next time. But somehow, next time comes… and so does the cart.

Here’s the thing — you’re not careless or bad with money. You’re just up against a brain wired to love the feeling of buying more than the thing itself.

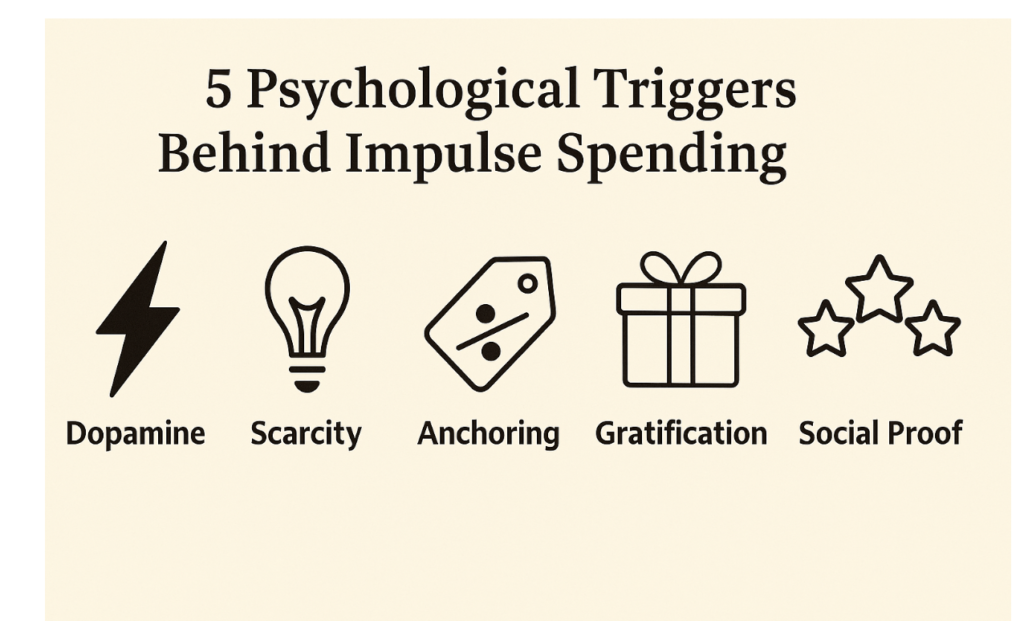

In this article, we’ll break down the psychological triggers behind impulse buying — and share 5 science-backed ways to stop it.

What Is Impulse Buying?

Impulse buying isn’t just shopping without a list — it’s spending triggered by emotion, not intention.

It’s when you grab something not because you need it, but because it feels right in the moment. You’re not thinking long-term. You’re chasing relief, excitement, or maybe even boredom’s exit sign.

And here’s the kicker: studies show up to 90% of us make impulse purchases — often triggered by internal states like stress or by external cues like sales and urgency.

The psychology behind it is subtle, powerful, and baked into your daily life — especially online.

The Psychology Behind Impulse Buying

Your unplanned purchases aren’t random — they’re often triggered by deeply studied patterns in human behavior. Here’s what psychology reveals about why it happens.

1. The Dopamine Hit (Reward Anticipation)

Based on: Berridge & Robinson’s Reward Theory (1998)

Let’s start with the brain’s favorite chemical: dopamine. It’s often called the “pleasure chemical,” but really, it’s about motivation and anticipation.

Researchers Kent Berridge and Terry Robinson discovered that dopamine spikes when you expect a reward — not when you actually get it. So when you see a tempting product or sale, your brain lights up with possibility: This could be amazing! Even if the purchase ends in regret, the chemical thrill already happened.

That’s why clicking “Buy Now” feels like progress — even when you don’t need the item.

2. The Scarcity Effect

Based on: Dr. Robert Cialdini’s Principles of Persuasion

Cialdini, a psychologist who spent years studying how people are persuaded, found that scarcity makes things feel more valuable — simply because they’re limited.

When a product says “Only 2 left,” your brain interprets it as: This must be important — or I’ll miss out. Even if you didn’t want it before, the fear of losing the opportunity makes it feel urgent and desirable.

This trick is used everywhere from airline seats to flash sales — and it works because your brain’s wired to avoid loss more than it’s drawn to gain.

3. Loss Aversion and Anchoring

Based on: Kahneman & Tversky’s Prospect Theory (1979)

Economists Daniel Kahneman and Amos Tversky found something strange: we hate losing more than we love winning. That’s called loss aversion.

It explains why “Was $150, now $75” feels like a great deal — not because we need it, but because we feel like we’re avoiding a $75 loss. That original price becomes our anchor — a mental reference point that makes the current price seem irresistible.

Your brain isn’t measuring value. It’s reacting to a clever price illusion.

4. Instant Gratification Bias

Related to: Hyperbolic Discounting

This one’s about timing.

Hyperbolic discounting is a fancy term that explains why we value smaller rewards now more than bigger rewards later — even if we know the future reward is better.

It’s why saving $100 feels boring, but spending $25 on a late-night buy feels oddly satisfying. Your brain doesn’t like waiting. And when you’re stressed, tired, or distracted? That bias kicks in even harder.

5. Social Proof and Emotional Contagion

Based on: Solomon Asch’s Conformity Experiments (1951)

In the 1950s, psychologist Solomon Asch showed that people often change their answers to match the group, even when they know the group is wrong. Why? Because we’re wired to fit in.

Now imagine scrolling through five-star reviews, influencer recommendations, or “people also bought…” lists. That’s digital social proof in action. We assume if others love something, we will too — and that makes it feel safer to buy.

Even seeing a product labeled as “popular” can push us to purchase it faster, whether or not we need it.

5 Research-Backed Ways to Stop Impulse Buying

Now that you know what’s driving those unplanned purchases, here are five realistic ways to take your power back — without ditching joy or becoming hyper-disciplined.

1. Interrupt the Pattern with a Delay Rule

Impulse feeds on immediacy. Introduce friction.

Try the 24-hour rule (or even 1 hour). Want it? Add to cart, walk away, revisit later. If the thrill fades, it wasn’t the item you needed — it was the moment.

2. Rewire the Scarcity Reflex

Flip the script. If something says “Only 1 left,” ask yourself: Would I want this at full price, a week from now?

Also: create artificial scarcity for savings. Automate transfers into a “future-you” fund before spending. Now that urgency works for you.

3. Pre-Anchor With Intention

Before browsing, set a mental price cap or specific need. Example: “I’m only looking for a charger under $25.”

This helps override the price slashing illusion and keeps your decisions tied to logic, not hype.

4. Reward Non-Spending Wins

Track non-purchases like wins. “Didn’t buy the thing, walked away.”

Create a habit tracker or savings goal that shows real progress every time you pause instead of purchase.

Let your dopamine spike come from self-control, not shipping updates.

5. Curate Your Digital Environment

Unsubscribe from impulse-triggering emails. Mute flash-sale apps. Unfollow “haul culture” content.

Instead, follow creators who focus on intentional living or value-based spending. Social proof can lift you up too — if you choose the crowd.

Take This With You

Impulse buying isn’t about lack of willpower. It’s about how your brain responds to triggers — and how expertly the world has learned to pull them.

But now you know the game.

And when you recognize the psychological plays — the dopamine buzz, the fear of missing out, the manufactured urgency — you get to decide differently. Not always perfectly. But more consciously.

ACT NOW!

You’ve seen how easily your brain gets hijacked.

Buy Aware is your digital defense — a financial self-awareness tool that helps you catch emotional spending before it happens.

Train your brain to pause. To choose. To win.

Most people will keep scrolling.

But if you’re one of the self-aware few — you can be among the first 50 to unlock early-access pricing and start today.

Leave a Reply